, consisting of exactly how rates are established and also what different coverage is readily available. Get the lowest rate. Acquisition your plan with the brand-new service provider at your lower price. insured car.

3Shop around with multiple companies, There are no policies on Learn here exactly how insurance policy business create their algorithms to determine your rate. Contrast quotes from even more than one cars and truck insurance policy company if you are thinking about making a button.

What to Do if You Have a Truly Poor Driving Document, If you have a truly bad driving record, either due to several mishaps or from a higher-risk citation like a DUI, you will face greater insurance coverage prices and might have to look around to locate a business that will insure you. cheaper.

These include: Driving document Kind of car insurance policy Extent of the accident Another aspect is the nature of the mishap. You may be marked as a high-risk vehicle driver in Maryland if the mishap is classified, relevant, or the result of any of the following: At mistake crash Speeding up Competing Drunk driving conviction Distracted driving Reckless driving Offenses of other Maryland driving regulations Just how your automobile insurance coverage prices are impacted after a crash varies from state to state.

As a whole, Maryland is reported to have among the lowest boosts in premiums after a cars and truck accident. In the United States, the ordinary rise is $2,010. However, in Maryland, the ordinary superior increase for cars and truck insurance for an at-fault cars and truck accident is just $1,900. In connection with your very own insurance policy, expect a rise to your automobile insurance coverage costs to enhance 21.

If you are to criticize for the crash, most likely your cars and truck insurance policy will go up. The even more offenses you get related to the crash, the much more your vehicle insurance will certainly go up.

How Much Does Insurance Go Up After An Accident Detail Guide for Beginners

If it is an extra severe violation such as Drunk drivings or DUIs expect your cars and truck insurance coverage will certainly go up around an added $490 annually. Why Do Insurance Rates Rise After a Cars and truck Crash Since many motorists that are at mistake in a car crash typically end up causing an additional crash, they are viewed as higher danger.

A cars and truck insurer integrates the expense of an insurance coverage plan with the added risk of the driver. Leading to greater costs for automobile insurance for chauffeurs that are thought about risky. For How Long Will My Cars And Truck Insurance Price be Higher After a Crash How much time your car insurance remains high will certainly be details to your insurance company, the intensity of your accident, as well as your state.

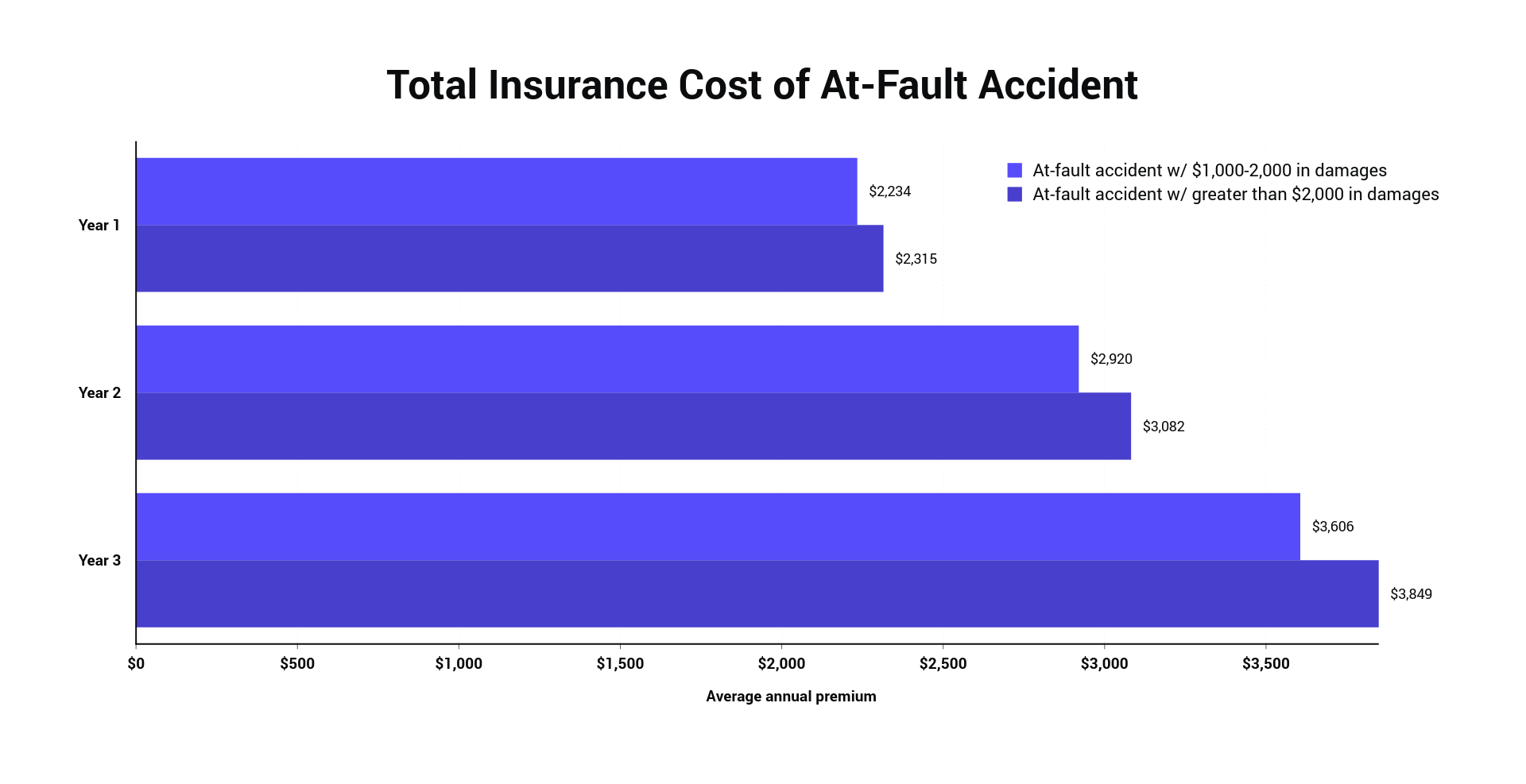

As an example, if you are located at fault in an automobile mishap that caused damages to your lorry over $2000, you can expect increases in your cars and truck insurance policy to last for 3-5 years. That is a very specific instance though. The intensity of the crash and also infractions considerably affects exactly how lengthy your insurance coverage will be greater.

Exactly How Can I Obtain a Cheaper Vehicle Insurance Policy After a Car Crash? If you create an accident there is little you can do to stay clear of greater automobile insurance policy prices.

In the short term to get cheaper cars and truck insurance policy after an automobile crash, you need to check out different suppliers. Each service provider manages chauffeurs differently. You will still be taking a look at a rise to your insurance policy after the accident. You may be able to locate a service provider who will enhance your price much less than your existing supplier.

Ask for Crash Mercy This is something that requires to be done when going shopping for insurance. Prior to obtaining in an accident, look for an insurance firm that has crash mercy.

Some Ideas on What Affects Car Insurance Premiums - State Farm® You Need To Know

insured car low-cost auto insurance affordable auto insurance cars

insured car low-cost auto insurance affordable auto insurance cars

In instances that you look for and also are given crash mercy, your car insurance policy prices will not go up. Attend Website traffic Institution Many insurance providers will lower rates for motorists that have a background of automobile crashes if they attend web traffic school.

Do Not Submit Cases for Tiny Things The regularly you make claims, the much more your insurer has to make payments. Therefore it is important you just submit cases for major damages to building or for accidents that need assistance. If you filed a claim recently in an at-fault car crash, delay filing additional claims for as long as you can.

Your vehicle insurance coverage firm examines their clients' costs on the threat they position to the company financially. Increase Your Credit rating Score In general, individuals with credit score scores that are a lot more than 600 experience much better premium offers.

This may take a while, but it will settle over time. 4. Consider Your Deductible There is an inverted relationship in between your insurance coverage deductibles as well as your insurance policy costs. By selecting a lower insurance deductible you will certainly have a higher premium. On the other hand having a greater insurance deductible will certainly cause a reduced costs.

Do Car Insurance Rates Increase In A Different Way Based Upon Age? In Maryland, cars and truck insurance policy prices vary based on the vehicle driver's age. As a whole, a new motorist or teenager will have substantially higher insurance policy than an experienced motorist or someone that is older. Younger as well as brand-new motorists as well as young adults have greater rates since they are classified as potential greater threats - trucks.

Leaving your insurer with no expenses associated to the mishap. Ultimately your auto insurance policy offers thinks about how costly it is to insure you. If you are at mistake for a crash that makes you a greater risk. If you have been in serval accidents that are not at mistake your danger degree still raises.

Some Of 9 Ways Retirees Can Whittle Down Their Car Insurance Costs

low cost auto car insurance insured car liability

low cost auto car insurance insured car liability

Despite who is at mistake. Will a No-Fault Vehicle Crash Show Up on My Record? No-fault car crashes do show up on your driving record. You may have a tidy document and also take into consideration an excellent motorist. Nevertheless, when you sue and also an insurance company offers you cash that will lead to the crash being put on your driving document.

When a vehicle driver that is at at-fault does not have insurance coverage then your insurance policy business becomes accountable to spend for injuries as well as problems to your vehicle. Although it was not your mistake the mishap is much more expensive for your insurance provider when the at-fault vehicle driver is without insurance. Therefore, elevating your car insurance coverage premiums.

It is very important for you to stay clear of interacting with them whenever possible to avoid being labeled a high-risk driver by them. The Conclusion on Vehicle Insurance Coverage Rates and Accidents It is always a far better scenario when you are not at mistake for a mishap. prices. Your insurance coverage may still increase, yet not nearly as much.

If you have been in a mishap and need lawful help, please call ENLawyers.

insurers cheapest auto insurance credit score cheaper

insurers cheapest auto insurance credit score cheaper

So, if you're thinking of getting that desire car you've constantly desired, talk with your insurance business about how your rates will certainly be influenced. Remember luxury autos aren't the only ones that are at a risky of theft. Thieves also target cars and trucks with high-demand components. 5. Including a vehicle driver to your policy, All the elements above as they refer to an additional chauffeur on your policy can eventually affect your price.

Anxious about guaranteeing your teenager chauffeur? If they have a grade point average of a B or much better, they might get approved for our Excellent Student Price Cut. vans. Beginning your quote today for more information.

Unknown Facts About What Affects Car Insurance Premiums - State Farm®

Teens are generally a liability behind the wheel (car). You could pay more for insurance if you are a teen chauffeur or have a teen running your lorry. Just How Can You Decrease Your Cars And Truck Insurance Price? Right here are some means you can decrease your auto insurance policy price: An accident or website traffic infraction will create your rate to go up, so be a good vehicle driver behind the wheel.

The expense of your vehicle insurance premium is based upon a variety of aspects, from your age, gender, marriage status, and where you intend to park the cars and truck, to your driving historyincluding any mishaps or website traffic infractions on your record. Simply due to the fact that you've had mishaps in the past does not imply your insurance premiums will certainly be influenced for life.

While the specific calculations used to establish premium costs differ from one insurance provider to one more, it may be useful for drivers to understand just how lengthy mishaps generally can remain on their insurance policy. perks. Below's just how accidents can influence what you pay for cars and truck insurance policy, so you can make the very best choices for your driving needs.

Costs are based on the insurer's opportunities of having to pay a case. Normally speaking, a chauffeur the insurance provider considers as high-risk likely will pay more cash for vehicle insurance policy than a chauffeur the business sees as low danger - cheap car insurance. This is why cars and truck crashes can impact your insurance policy premium, also if you were not at mistake. Obtaining right into an accident likely will result in a premium increase regardless of what, and also you can expect the boost to be greater if you created the mishap than if you were not liable. The golden state and Oklahoma have banned the technique of increasing vehicle insurance premiums for vehicle drivers that remained in not-at-fault accidents.

Typically talking, crashes might remain on your record for 3 to 5 years. Premiums might increase and also stay at a greater price for at the very least a couple of years after the accident, yet it can vary by insurance provider as well as state. In basic, you can anticipate more severe accidents, such as ones triggered by driving intoxicated (DUI) or careless driving, or multiple crashes in a brief period of time, to remain on your document longer than a minor solitary accident.

All of this depends on the insurance policy firm, too. Modern states on its web site that at-fault accidents may increase a chauffeur's premium by up to 28%. Inspect with your insurance coverage business to understand just how a mishap will certainly impact your insurance coverage costs.

What Does Why Did The Cost Of My Car Insurance Go Up At Renewal Time? Mean?

: Minimizing your limitations or increasing your insurance deductible might possibly obtain your vehicle insurance costs closer to where it was prior to the mishap, although you'll be compromising some coverage.: If your insurance company also uses home owners or tenants insurance coverage, you may have the ability to reduce your auto insurance plan by purchasing an additional plan with them - car insured.

If you drive much less than the ordinary variety of miles per yearwhich is 13,476, according to the Federal Highway Administrationthen you might have the ability to get approved for a low-mileage price cut (insurance). All-time Low Line Although you can expect an accident to affect your insurance coverage, it will certainly not continue to be on your document forever.

Insurance business use your accident history to help figure out the cost of your premium. Having a major at-fault crash or several at-fault crashes on your record likely will cause an exceptional boost for a couple of years, as well. Nonetheless, the certain boosts differ from insurer to insurerand some companies are even going to forgive accidents.

That suggests a mishap doesn't have to thwart your car insurance coverage budget plan (auto).